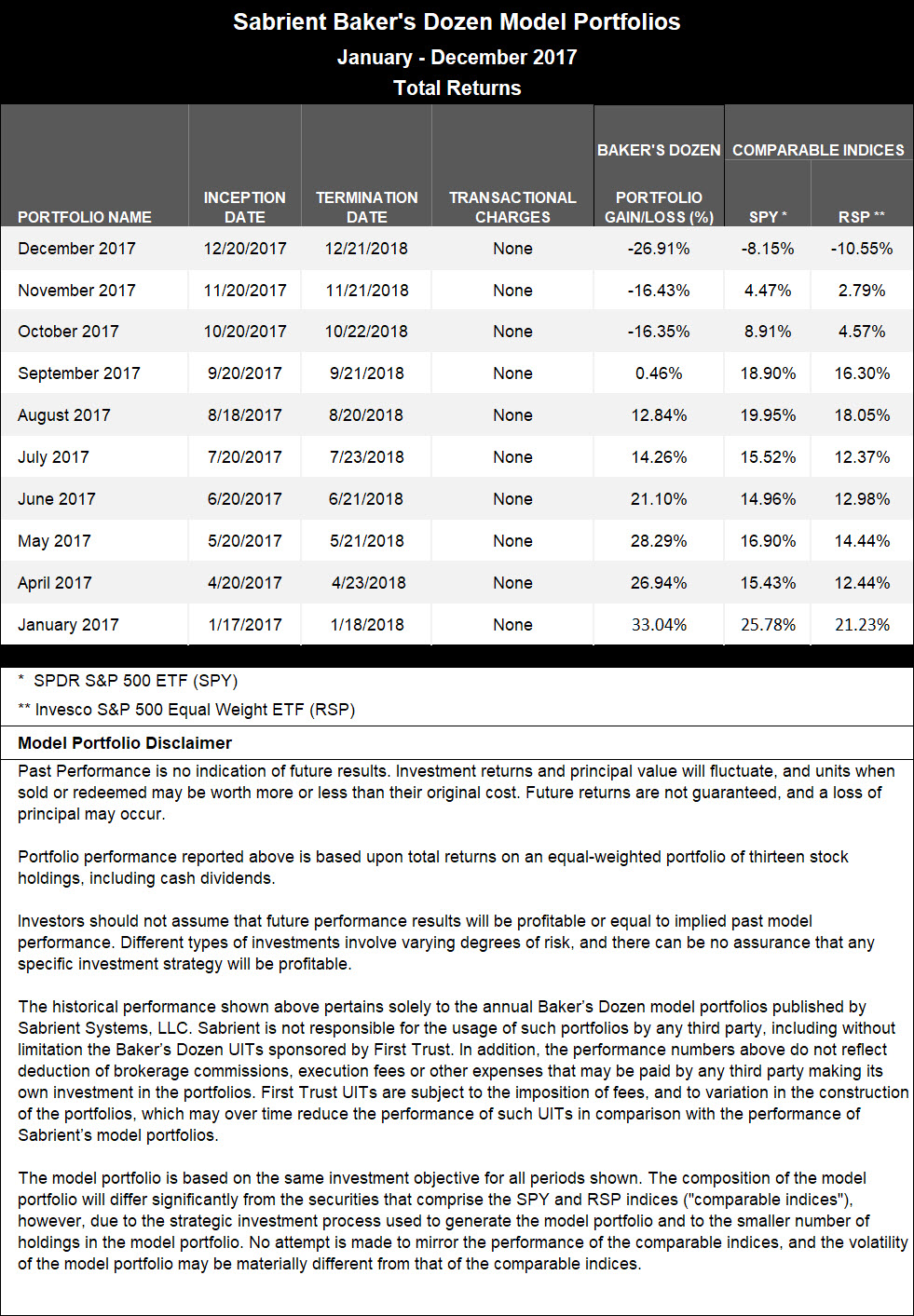

Closed Portfolios - 2017

A summary of the performance of the closed 2017 Baker's Dozen Model Portfolios is shown below; below the summary are the actual portfolios.

Note: Since January 2009, Sabrient has published annual model portfolios. Beginning in April 2017, Sabrient began publishing monthly portfolios. There were no monthly portfolios in February or March of 2017.

Performance Summary

The performance of the model portfolios is presented with total returns. Gains and losses shown are for a hypothetical model portfolio and do not take into account any fees that would apply to actual transactions. Scroll down to see the actual portfolios and additional disclaimers.

2017 Model Portfolios

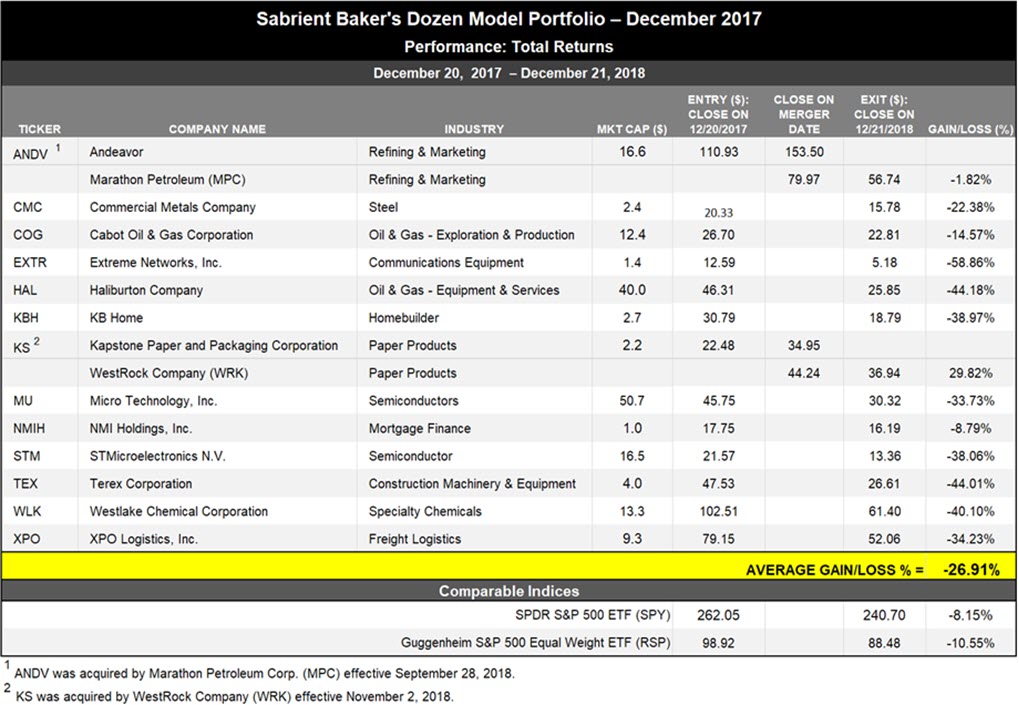

December 2017

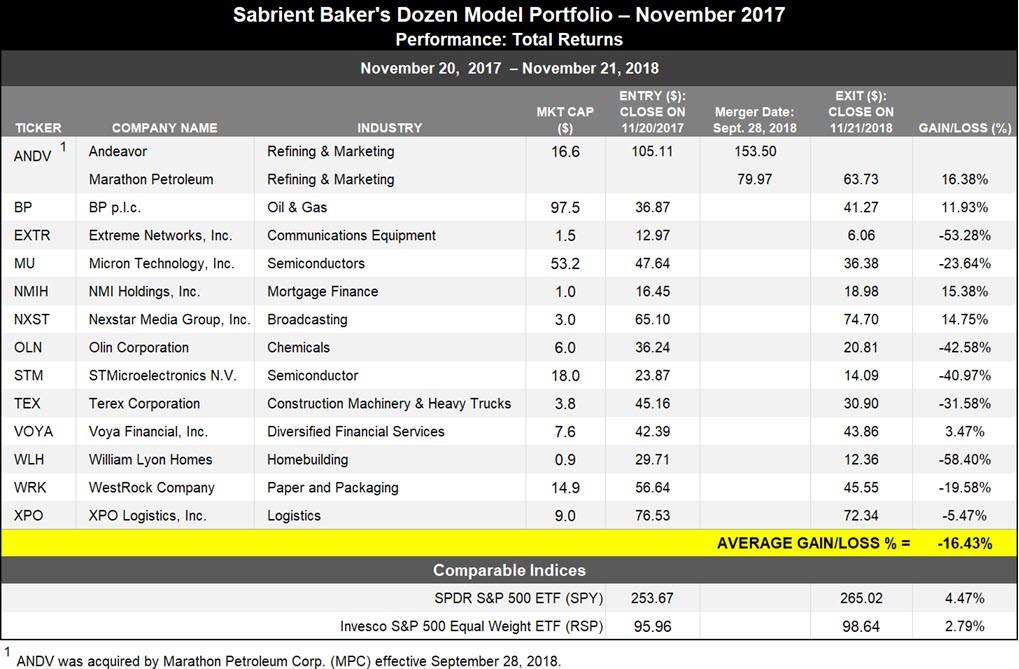

November 2017

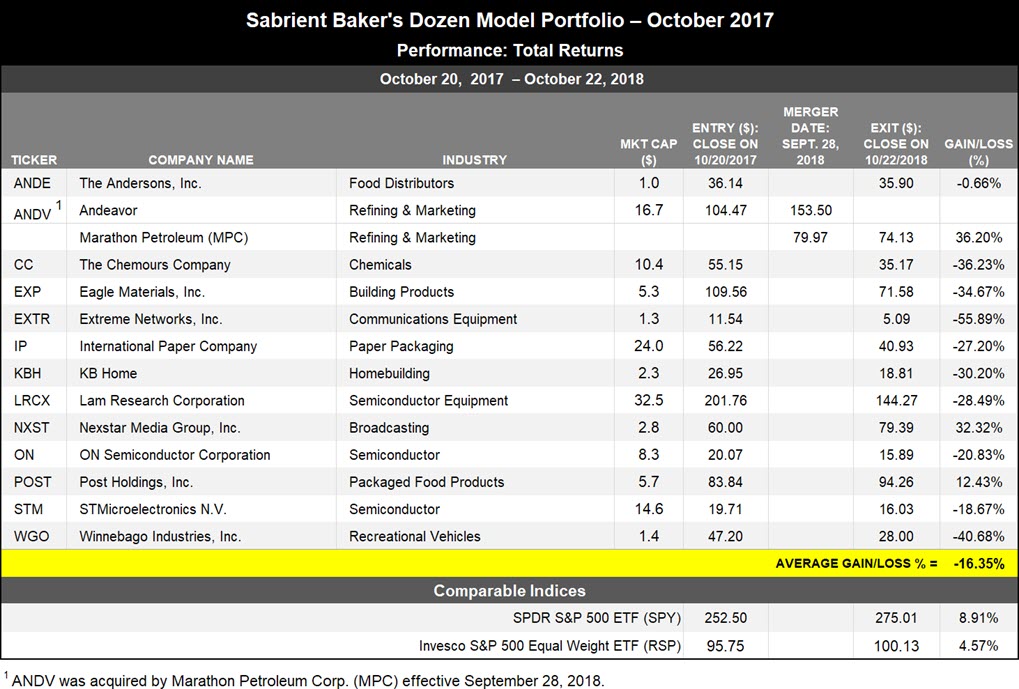

October 2017

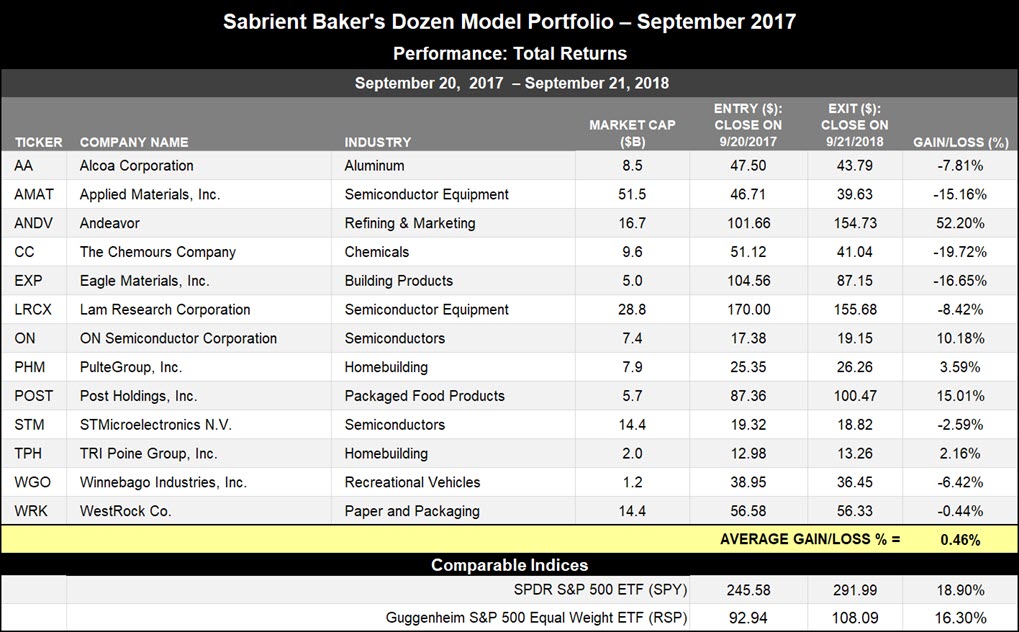

September 2017

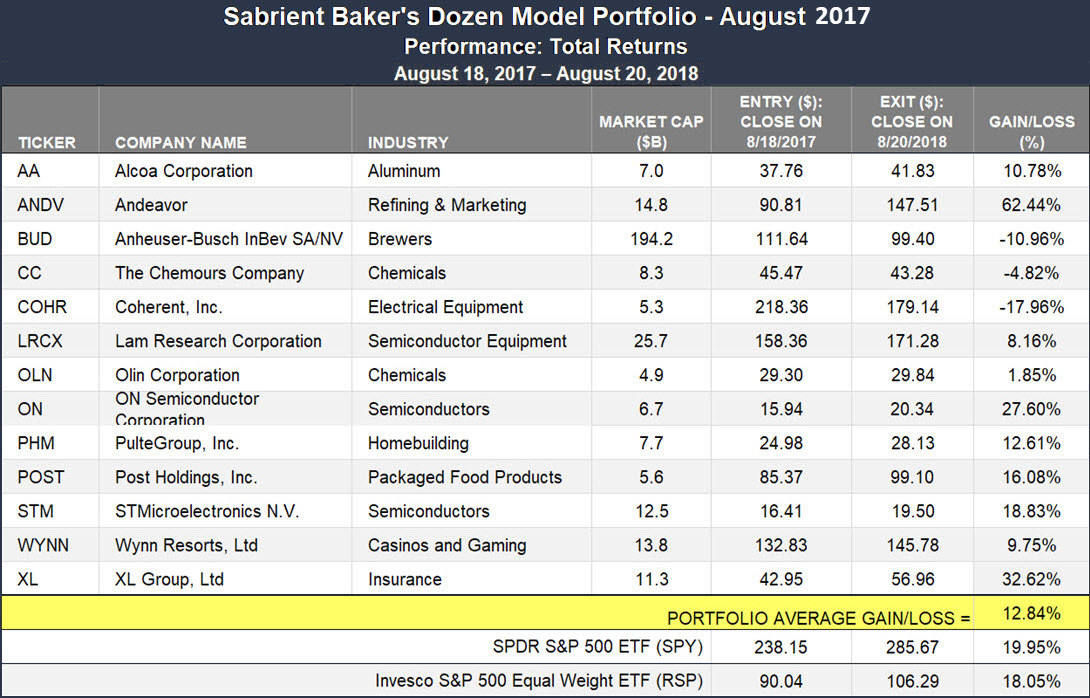

August 2017

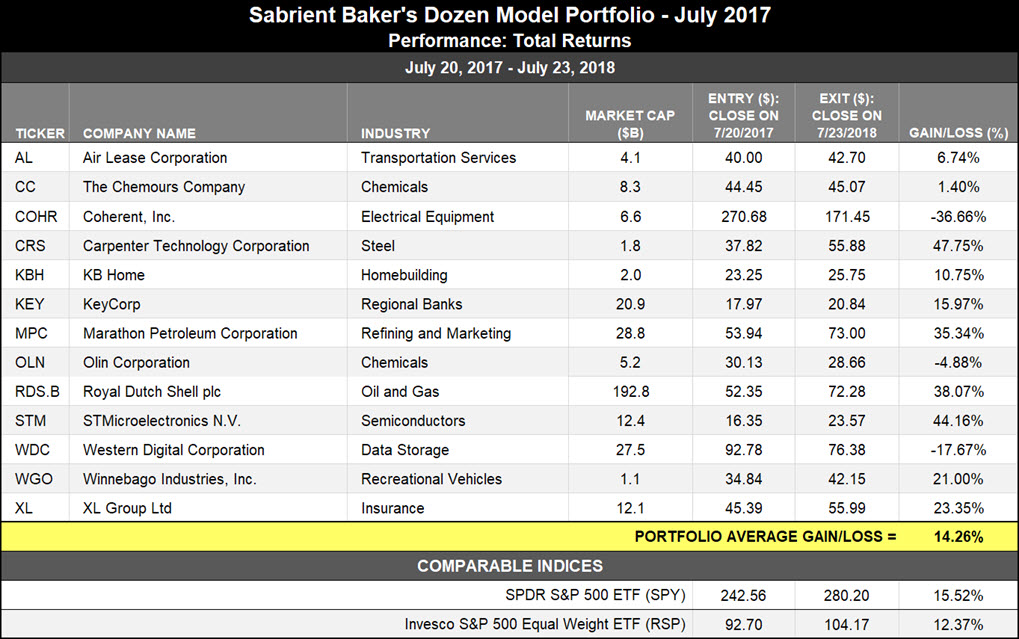

July 2017

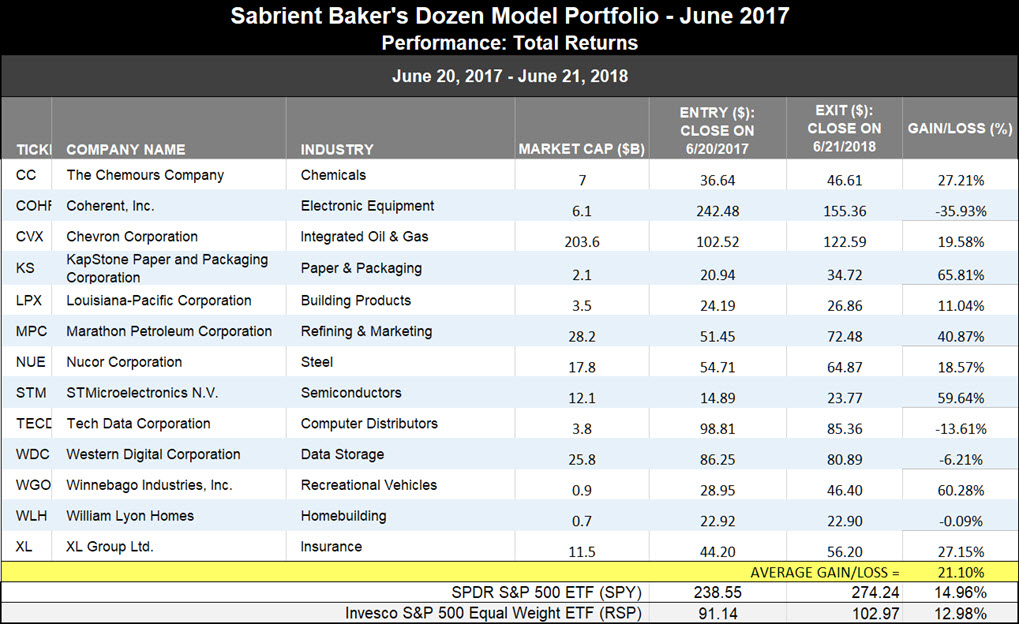

June 2017

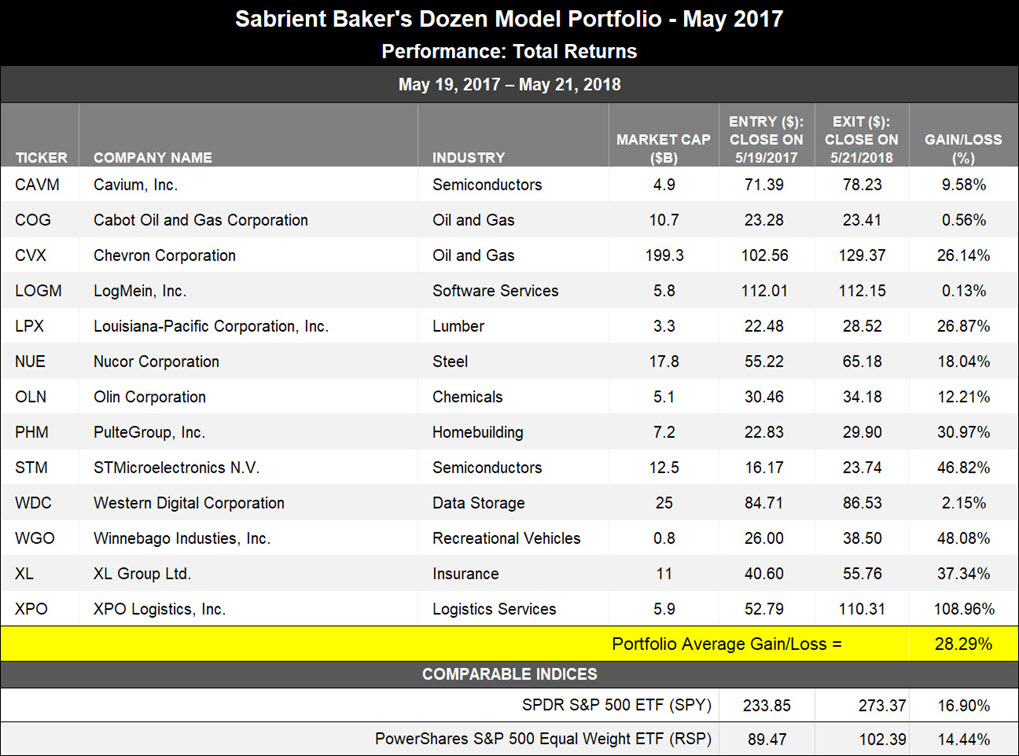

May 2017

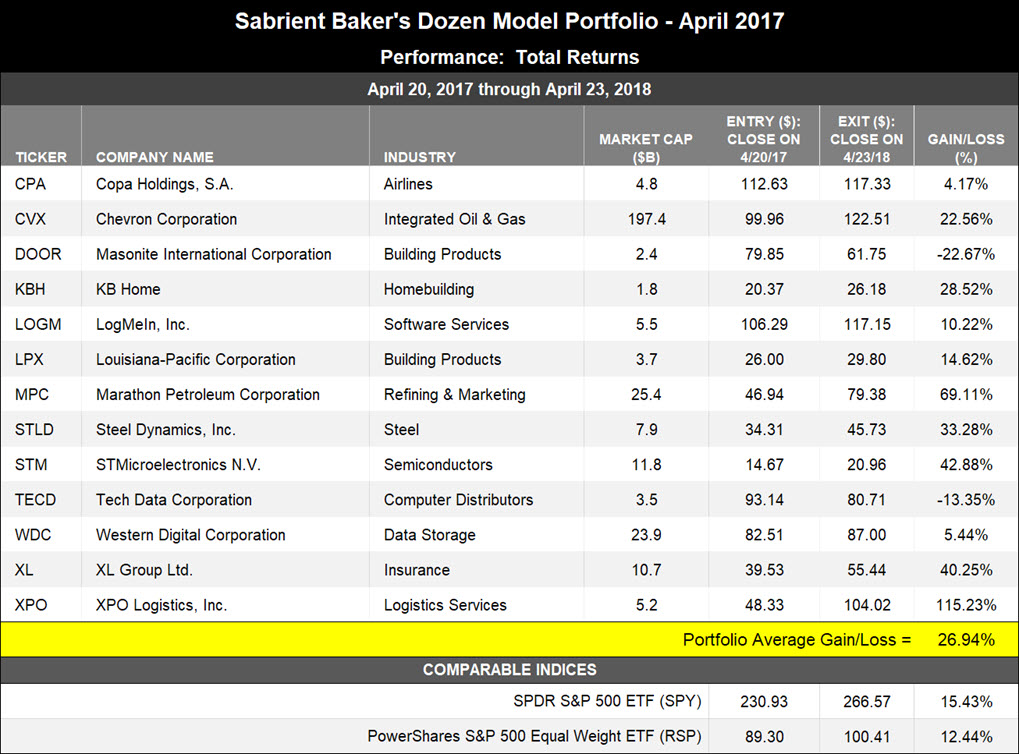

April 2017

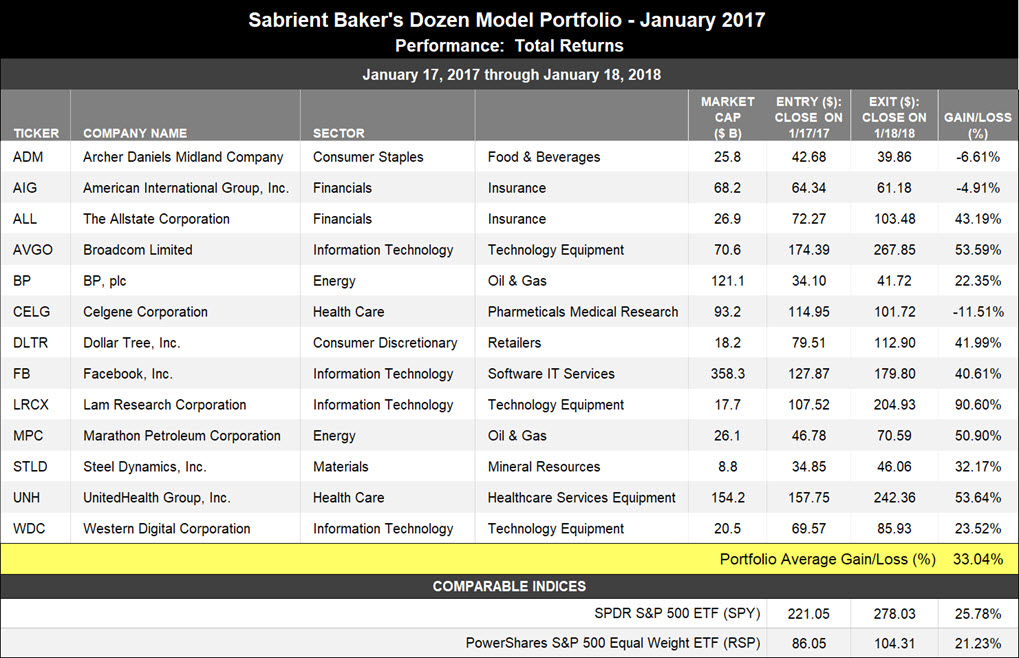

January 2017

Disclaimer

Past Performance is no indication of future results. Investment returns and principal value will fluctuate, and units when sold or redeemed may be worth more or less than their original cost. Future returns are not guaranteed, and a loss of principal may occur.

Portfolio performance reported above is based upon total returns on an equal-weighted portfolio of thirteen stock holdings, including cash dividends.

Investors should not assume that future performance results will be profitable or equal to implied past model performance. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment strategy will be profitable.

The historical performance shown above pertains solely to the annual Baker’s Dozen model portfolios published by Sabrient Systems, LLC. Sabrient is not responsible for the usage of such portfolios by any third party, including without limitation the Baker’s Dozen UITs sponsored by First Trust. In addition, the performance numbers above do not reflect deduction of brokerage commissions, execution fees or other expenses that may be paid by any third party making its own investment in the portfolios. First Trust UITs are subject to the imposition of fees, and to variation in the construction of the portfolios, which may over time reduce the performance of such UITs in comparison with the performance of Sabrient’s model portfolios.