Closed Portfolios - 2009 - 2012

Since January 2009, Sabrient Systems has launched an annual Baker's Dozen Model Portfolio. Using our fundamentals-based quantitative approach, we select 13 top-ranked stocks that represent a cross-section of industries that we believe are position to perform well in the coming year. These are GARP stocks (stocks that represent "growth at a reasonable price"), and they are meant to be held for the full 12-month term of the portfolio.

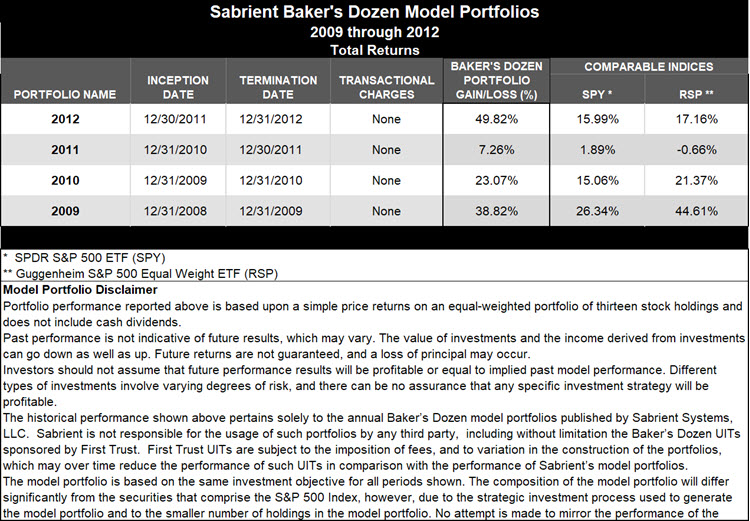

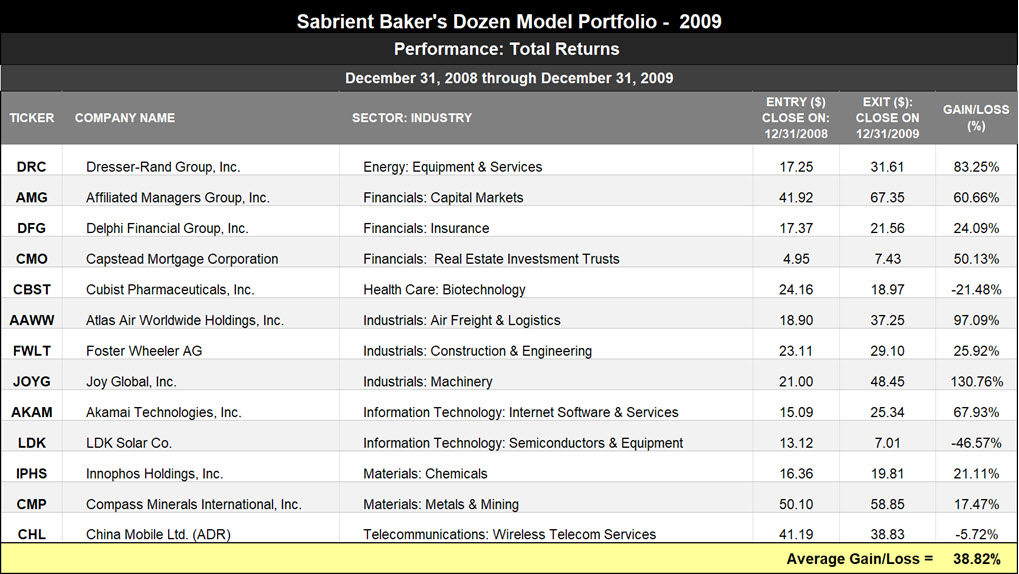

A summary of the performance of the 2009 through 2012 Baker's Dozen model portfolios is shown below. Below that are the actual portfolios.

Performance Summary

The performance of the model portfolios is presented with total returns. Gains and losses shown are for a hypothetical model portfolio and do not take into account any fees that would apply to actual transactions. See additional disclaimers below.

Data source: Thomson Reuters

2009 - 2012 Portfolios

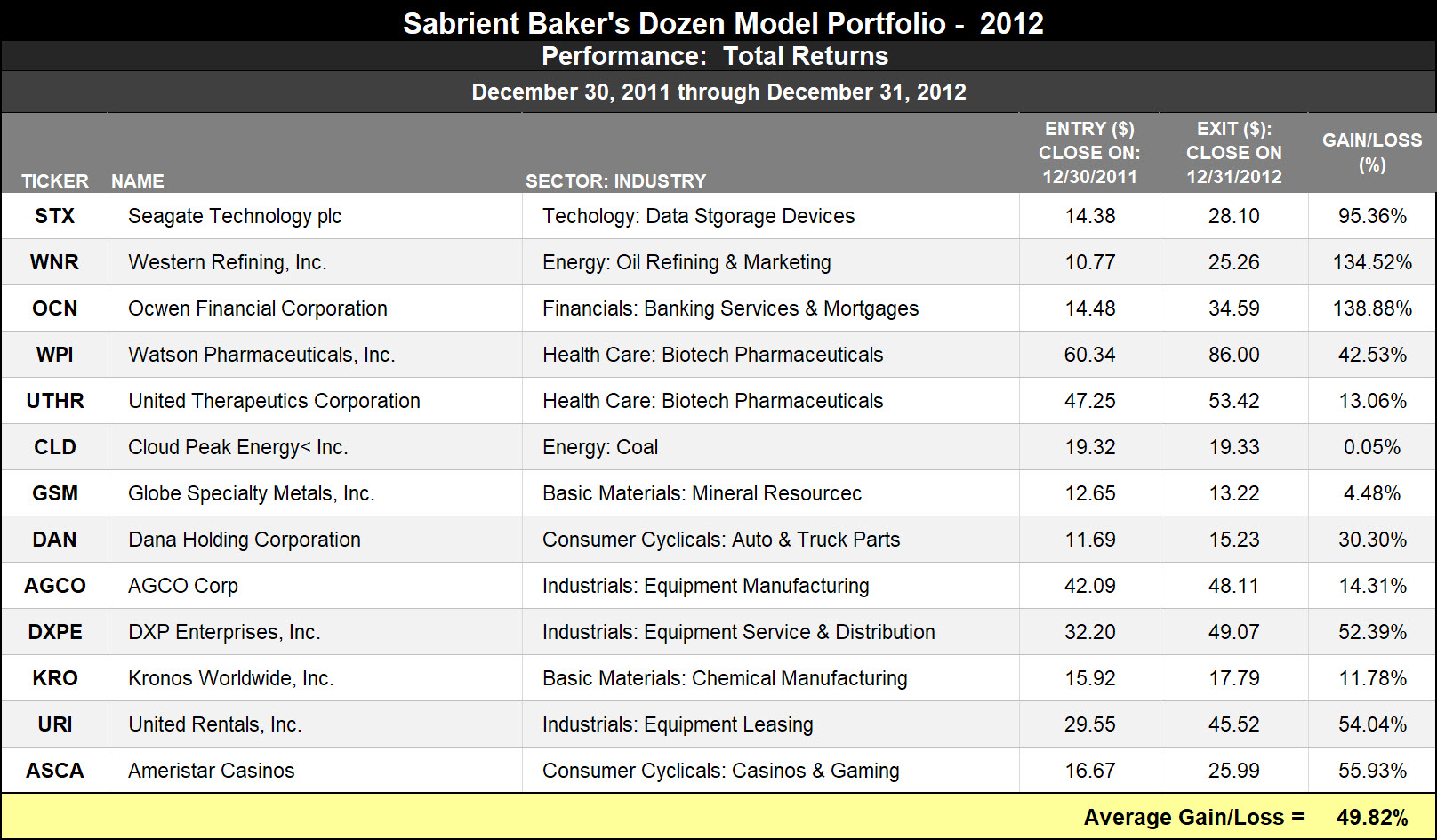

2012

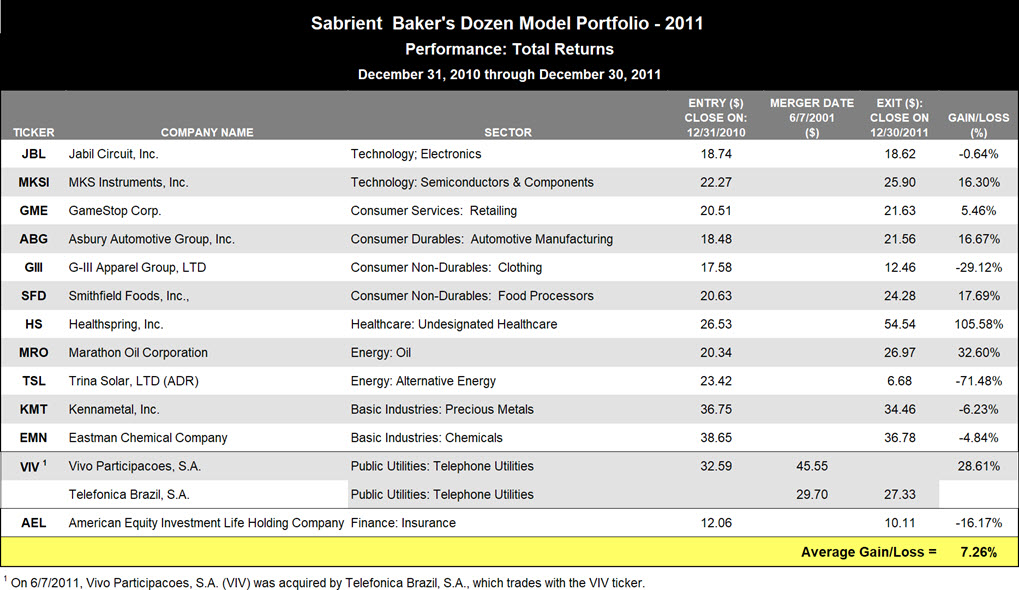

2011

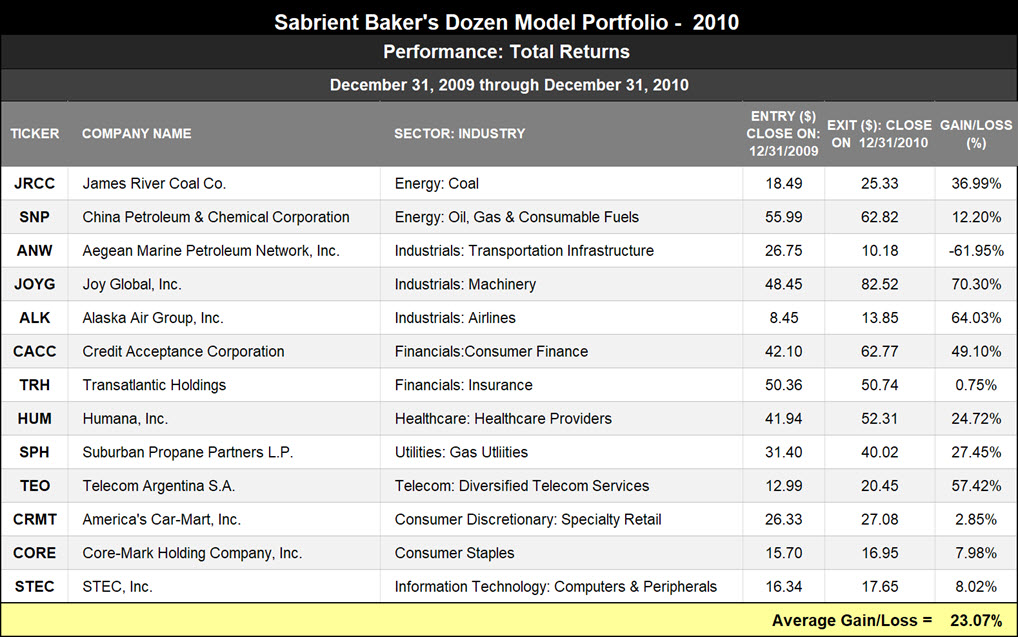

2010

2009

Disclaimer

Past Performance is no indication of future results. Investment returns and principal value will fluctuate, and units when sold or redeemed may be worth more or less than their original cost. Future returns are not guaranteed, and a loss of principal may occur.

Portfolio performance reported above is based upon total returns on an equal-weighted portfolio of thirteen stock holdings, including cash dividends.

Investors should not assume that future performance results will be profitable or equal to implied past model performance. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment strategy will be profitable.

The historical performance shown above pertains solely to the annual Baker’s Dozen model portfolios published by Sabrient Systems, LLC. Sabrient is not responsible for the usage of such portfolios by any third party, including without limitation the Baker’s Dozen UITs sponsored by First Trust. In addition, the performance numbers above do not reflect deduction of brokerage commissions, execution fees or other expenses that may be paid by any third party making its own investment in the portfolios. First Trust UITs are subject to the imposition of fees, and to variation in the construction of the portfolios, which may over time reduce the performance of such UITs in comparison with the performance of Sabrient’s model portfolios.